This 🇸🇦 Tech Stock You've Never Heard of did 500% in 3 years🔥

Is there room for more growth? The short answer is Yes.

👋 Hello All

Welcome back to Free Capital 💅🏻

Before we start, here’s the Cliff Notes of the company we’re looking at.

✍️ Summary

Honestly, I did a triple take when I first saw this stock. Listen yanni, this is the poster child of hidden gems! A long-time IT service partner to the Saudi government, this company is now leveraging its early advantage into greater market share across cloud, cybersecurity and AI, backed by strong revenue growth and double-digit operating and net margins. As Saudi Arabia continues spending on digitisation and infrastructure to build out its vision of a new, non-oil economy, this company is cementing its dominance - upselling to existing clients, partnering with new entrants, creating solutions for focus sectors, and acquiring competitors. If you are wondering how to benefit from the billions that Saudi is spending on modernising its economy (~306 billion $ per year), this is your way in (and up).

🔦 Today’s Focus: Elm Co. (ELM)

🔤 Ticker: TASI : 7203 • Tadawul Stock Exchange • Saudi Arabia 🇸🇦

What we are going to cover today:

✅ What Elm Co. does

✅ How it is performing

✅ Why it is attractive

✅ What it could be worth

To help you convert any numbers you read, SAR = Saudi riyals (KSA local currency), and it is fixed to the USD at a rate of ~ 3.75.

✅ What They Actually Do

Though its legacy began in government, Elm Co. now provides technology solutions and professional services to both public and private customers. The company has a long history, but a short one in the stock market. What started in 1988 as an IT research and development company, providing services exclusively to the Ministry of Interior of Saudi Arabia, eventually grew in scale and scope to the Elm Co. of today. Here’s how:

2002 - 2004: Name changes to Al Elm Information Security Company; shifts focus from research and development to delivering information security and e-government services. Main customers at this point are the Ministries of Interior, Human Resources and Social Development, Hajj and Umrah, and the Ministry of Justice.

2007: Converts into a closed joint stock company owned 100% by the Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund. Continues providing government services primarily, and expands into Business Process Outsourcing.

2012: Expands its services to the private sector, offering electronic connectivity services, call, service and data centres, cybersecurity, information systems and communication networks.

2021 - 2022: Name changes to Elm Company; lists 33% of share capital on the Tadawul stock exchange, for public ownership (PIF still owns 67%).

Elm has 3 main business segments:

Digital Business: integrated technology solutions, e-government platforms, digital transformation of legacy IT infrastructure, systems and cybersecurity.

Elm develops and operates digital platforms on behalf of its customers in government, automotive, healthcare, banking, insurance, travel, transportation, logistics and real estate. These platforms enable Elm’s clients to solve their business needs, or digitise traditional processes.

Business Process Outsourcing: call centres, service centres, crowd management, business operations, and field inspection services. Here, Elm tenders for service management contracts, and finds ways to upsell clients towards digitisation services. The company offers 3 main types of BPO services:

Operating business centres on behalf of the government e.g. the contract to operate the Heritage Commission’s centres, and the contract to supervise AlUla Airport with the Royal Commission of AlUla.

Inspection and control services e.g. the inspection contract for the city of Makkah, where Hajj and Umrah pilgrimages are performed.

Digitisation e.g. their real estate digitisation contract with the Ministry of Justice, contracts for printing electronic ID documents - passports, tourist smart cards, etc.

Professional Services: consulting and advisory services in data analysis, AI, IT support, and workforce development.

✅ Who Is In Charge

The current CEO is Mohammad Abdulaziz Alomair. He took over in October 2024 from Dr. Abdulrahman Saad Al-Jadhi. Alomair has been with Elm since 2002, and worked his way up to the number 1 job, including being Chief of Digital Products and VP of Electronic Products. Othman Mohammed Al Tuwaijri has been CFO since 2018, pre-IPO.

🧐 How Are Their Finances?

Revenue:

Revenue has grown at a CAGR of 25% for the past 6 years, backed by Saudi Arabia’s significant government spend on digitisation and economic growth. Since 2018, the Kingdom has spent an average of 1 trillion SAR (306 billion $) per year on upgrading IT facilities, digitising processes, and making public processes and services more efficient. Elm has benefitted from this immensely, as its clients are in the industries that government has been spending heavily on: security, military, healthcare, manufacturing, logistics, transportation, and education.

Revenue by Business Segment:

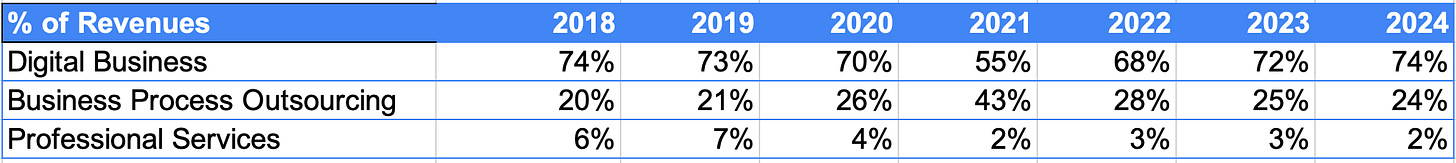

The Digital Business segment is easily the money-maker for Elm; it generates over 70% of revenues, and high-quality too, as they are recurring and product-based. Revenues from the other segments (Business Process Outsourcing and Professional Services) are mostly project-based and non-recurring.

The company has a total of 32 digital platforms, but 6 of these drive ~ 66% of Digital Business revenues and 48% of all revenues. These are their oldest portals, and were initially developed for government use, but now serve private clients as well.

Absher helps the Ministry of Interior automates all its services - ID registration, national address registration, and other biodata collection. Muqeem is a gateway portal for issuing entry and exit visas and for employers to manage immigration permits. Yakeen allows banks, insurance companies, government entities to verify the identity and data of anyone for transactions. Fasah is the electronic gateway for import-export operations, Tamm offers a portal for registering Saudi driving permits, and car ownership details, and Nusuk is a portal dedicated to all Hajj and Umrah travel logistics. Hajj and Umrah pilgrimages are massive sources of tourism in Saudi Arabia. In 2024 alone, 18.5 million pilgrims performed both Hajj and Umrah. These visitors need e-clearance from their home countries, entry permits, travel and hotel bookings. The Nusuk platform enables all these.

Elm makes money in one or more of three ways from each digital product it develops: subscriptions, transactions, or long-term revenue-sharing with its clients. Yakeen, for example, provides KYC for financial institutions, government entities and other businesses. Because KYC generates significant transaction activity, Yakeen makes money mainly through transactions. In addition, it offers 5 subscription packages, from Basic Yakeen to Yakeen IPO, which banks and brokers use to verify the information of IPO subscribers.

Mojaz is an all-in-one used car information portal that verifies car data for potential buyers, including previous ownership details, traffic reports, accident history, insurance information, and inspection reports. Elm earns money per transactions performed on Mojaz. These platforms may not sound super high-tech, but they make life extremely convenient for the 33 million people living in the massive landmass that is Saudi Arabia. For someone who lives in Riyadh and wants to buy a used car in Jeddah, Mojaz allows them quickly check a car’s history before deciding to drive 10 hours in 40 - 50 degrees Celsius heat to physically inspect and test-drive it. For my American readers, that’s 104 to 122 degrees Fahrenheit.

Revenue by Client Type:

The company’s history as a government ICT service provider gave it a strong foundation, but Elm has since pursued private sector clients, and it’s paying off. In 2019, private clients were just 45% of revenues; by 2024, that number had flipped to 61%.

💡Finding this valuable? A quick Like + Restack really helps our page and other readers discover these gems!

Costs:

Elm builds connections between its existing products, integrating them deeper into the client’s business, whilst using its Business Process Outsourcing and Consulting divisions as lead magnets to upsell existing clients or build new digital platforms for clients to plug-and-play into their business. This flywheel has allowed them to reduce the costs of delivering their services. Direct costs reduced from 65% in ‘20/’21 to 60% in ‘23/’24, and Operating costs from 20% to 18% across the same time period.

Profits & Margins

Gross margins have improved from an average of 35% in ‘18-’21 to 41% in the past 3 years (‘22-’24), Operating margins from 16% to 22%, and Net Profit margins from 15% to 23%. All of this is again driven mainly by the Digital Business segment; it generates 82% of Elm’s gross profits.

The combination of sharp revenue growth and declining costs has resulted in a 32% CAGR in gross profits, 40% in operating profits and 48% in net profits. Compared to revenues, profits are increasing at a faster rate. I believe this is a feature of Elm’s business, because their main revenue driver is the Digital Business segment - a highly scalable business model. The Digital Business segment has in-built economies of scale, costs less to operate and service the customer, and becomes more valuable as you add more customers or existing customers process more transactions. Once these digital platforms are up and running, except for routine maintenance, and customer service to troubleshoot, you are good to go. Yalla!